Communication is key when working with others, be they clients or colleagues. Effective communication means having the same understanding of subjects with colleagues and trust-building with clients. The emails accountants send, in particular, play a significant role in this aspect, as it is the primary mode of communication for many accounting firms.

It’s no secret that accountants’ email inboxes are quite chaotic. Here’s the data to support this statement:

- The average accounting professional handles 100–200 emails per day.

- Accountants’ email consists of either spam (18%) or irrelevant emails (72%), with useful emails making up just 10% of the inbox.

- Given a daily average of 200 emails, 24 hours are spent emailing each week.

We are here to help you find sense in emails and inboxes. This article will discuss various tips and strategies for mastering email communication as an accountant or accounting firm manager. We will cover topics from managing and writing emails as an accountant to cybersecurity.

How to manage accountants’ email inboxes more efficiently?

As mentioned previously, one of the main reasons accountants’ emails are chaotic is the overwhelming volume of messages received daily. You may have to send several reminders to multiple clients often.

The easiest way to start is by organizing and prioritizing emails by setting up folders. For example, create folders for newsletters, specific clients, projects, or reminders. This way, you’ll drastically reduce the time spent searching for the right emails.

Another way is to use an external source for holding data. Provide your clients with the necessary instructions and links to add documents to, for example, Dropbox or Google Drive. Keeping documents in various places can reduce the data cluster in your inbox.

To cut the time spent on email management, stop checking your inbox every 30 minutes. Instead, plan a few timeslots to check your email and deal with the letters immediately.

In addition, you can use a client portal where clients have to respond directly to the portal, and no message goes missing.

When opening a new email, try to answer these questions and act accordingly:

- Can you delete it without reading it?

- Can you deal with it instantly (with a short response)?

- Can someone else from your team action it?

It’s completely fine to own several email addresses. Separate your working and personal email, so you won’t be tempted to check at work or when resting. You don’t need to be available at all times.

To reduce the number of incoming messages in your inbox, use methods other than email to communicate with coworkers. For example, use Slack, Microsoft Teams, or phone calls to communicate with your colleagues. Use online calendars to book meetings, like Calendly or Google Calendar.

Key takeaways:

- Organizing your inbox removes the hassle of searching for data.

- Plan timeslots for checking email

- Deal with the received emails right away

How can accountants write emails that leave the best impression?

Moving forward from handling your inbox, the emails accountants send might have issues with wording. Understandably, we can’t all be copywriters. A good email’s intent is clear, written professionally, and has a consistent style with the emails sent before or by your coworkers.

Plain and clear subject lines also help to ensure that emails are opened as soon as possible and precisely understood. For example, a subject line like “Urgent: Request for Financial Statements” instead of “Financial Statements” will clarify that the email requires immediate attention.

Who wouldn’t want to get information as easily as possible? A well-structured email with proper formatting and bullet points displays information more effectively than a long letter. A little goes a long way. To deliver info quickly and easily, using bullet points to highlight data grants you better answers.

A little more complicated, yet over 100% more effective and time-saving, is using templates and automating (skip to the bottom to read more about automating emails) to reduce the time spent on emails. Templates also help you maintain a consistent style and leave a professional impression on clients.

To get you started, here’s an accounting email template for sending monthly financial statements to clients:

Subject: Monthly Financial Statement [Client’s Name] – [Month/Year]

Dear [Client’s Name],

We are pleased to present your Monthly Financial Statement for [Month/Year].

Attached you will find the statement of your financial performance for the month. We have also included a summary of the key figures for your convenience.

Please review the statement and let us know your questions or concerns. We would be happy to discuss any aspect of your financial performance.

Thank you for your continued trust in our services.

Sincerely, [Your Name]

We have created 11 more accounting email templates you can use in your accounting office > check them out on our blog.

It’s also essential to have best practices for responding to client emails, such as timely and professional responses. The best practice is obviously to respond as soon as possible. Let’s be realistic – the best-case scenario rarely happens. According to business etiquette, responding within 24 hours is acceptable. Happy clients are more likely to recommend your service to others.

Key takeaways:

- Have emails with a consistent style to leave the best impression

- Add precise subjects to emails.

- Use bullet points to highlight information.

- Create templates to save time.

- Respond to clients within 24 hours to leave a professional impression

Cybersecurity for accountants’ emails

An important part of email management is separating important emails from spam or scammers’ phishing for data. Because accounting is closely related to money and bank accounts, scammers are more eager to gather data.

To protect sensitive client information and financial data from cyber threats:

- Use strong passwords and change them regularly. Apply two-factor authentication to accounts.

- Update software regularly because the old software can’t compete with new threats

- Train employees to notice scam mail

How to identify suspicious emails?

Some common indicators of a phishing email include

- Spelling and grammar errors,

- Requests for personal information,

- A sense of urgency.

Key takeaways:

- For better security, use two-factor authentication, train employees, and use strong passwords

- Double-check any suspicious emails to discover phishing.

In conclusion, effective email management is crucial for the success of an accounting firm. Master the art of email communication through:

- Organizing and prioritizing emails;

- Writing professionally, with a consistent style and clearly;

- Utilizing email for various purposes such as project management, document sharing, and billing;

- Maintaining client confidentiality and compliance,

Having flawless email communication in an accounting firm can improve efficiency and client communication. Implementing the strategies discussed in this article can help to alleviate the pain points commonly faced in email communication, ultimately leading to a more prosperous and organized business.

Still suffering? How to make emailing easier? Try software.

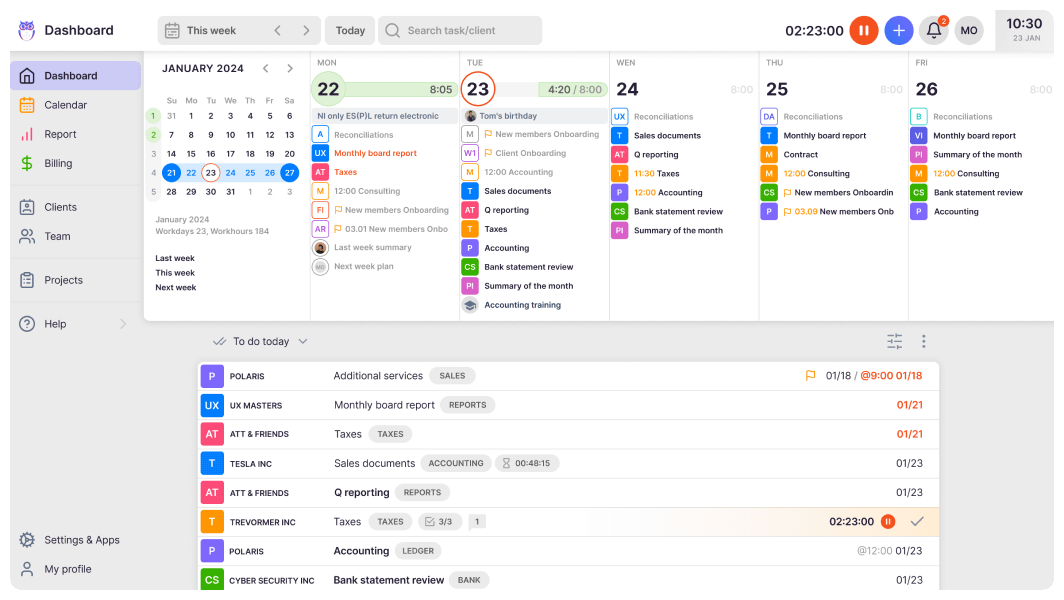

If you’re already using Uku for work management in your accounting firm, you’re in luck! We have been working hard to bring you a completely new app with many opportunities to make work easier and more efficient. Since December 2022, you can send out and automate recurring emails in Uku.

Why automate emails with Uku?

When writing the same emails over and over again, thinking of automating the letters is inevitable. In case you still need reasons why automate emails, here are the most compelling arguments:

1. Save time by having pre-written emails that go out automatically. Automating emails allows you to set up emails to be sent automatically at a specific time or in response to a certain trigger, such as receiving a client’s payment. This can save you significant time and allow you to focus on other tasks.

2. Pre-written and automated letters eliminate the potential for human error, such as typos or forgotten details, so your clients receive accurate and consistent information.

3.Use parameters like “{{client_name}}” for enhanced personalization, such as the recipient’s name or account details, in your messages. This can make your emails more engaging and increase the chances that the recipient will take the desired action.

4. Send the same message to multiple clients or leads at once, which can be especially useful if you have a large client base. This can help you scale your business without spending more time on administrative tasks.

We have now settled that software is a great way to make your work much easier and more effective. Uku, the work management software for accounting practices, offers work management, automated billing, CRM, and email management.

Why should I send emails from Uku when I already have an email service provider?

Here’s why:

Automate recurring emails.

Automating emails saves you time and ensures that the emails go to the right person at the right time. You no longer have to spend time sending the same letters to several clients because Uku does it for you.

Client communication and tasks in one place

Instead of using several programs to manage emails, in Uku, you can communicate with the client while completing tasks simultaneously. This way, there is less switching between windows, making keeping track of your work much easier.

Overview of communication with clients

The communication timeline gives you an overview of the emails you or your colleagues have sent to clients. Having all the communication in one place enables the team to monitor the client’s needs and wishes and allows you to respond quickly to their questions.

Fast communication with a consistent style

Create templates for these letters and automate them. That way, you and your colleagues don’t have to spend time writing letters and can save time using pre-written templates.

These options are just the tip of the iceberg. The email app can save time in your accounting firm in many ways. The easiest ways to discover them are:

- Use the Uku app itself

- Read more about the Email app from our blog

- Read more about the Email app from our help centre